|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Exploring the Best Mortgage Lenders in Hawaii for Your Home Financing NeedsUnderstanding the Hawaiian Mortgage LandscapeChoosing a mortgage lender in Hawaii requires understanding the unique aspects of the local housing market. With the beautiful scenery and vibrant culture, finding the right lender is essential for securing your dream home. Top Mortgage Lenders in HawaiiLocal Banks and Credit UnionsLocal financial institutions often provide personalized service. Some popular choices include:

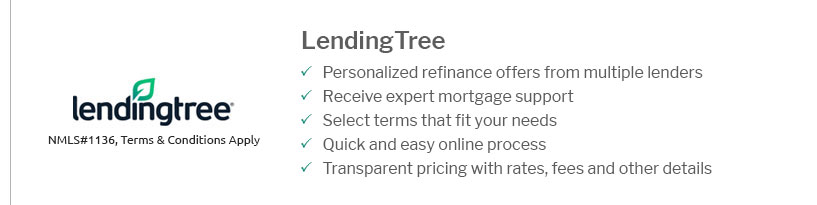

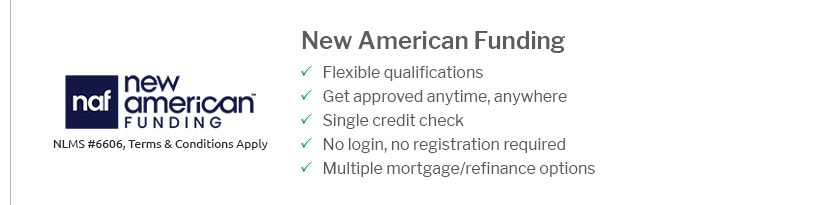

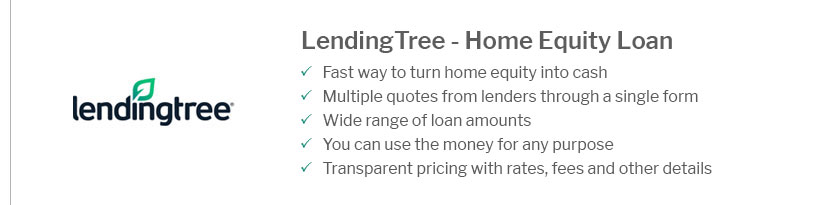

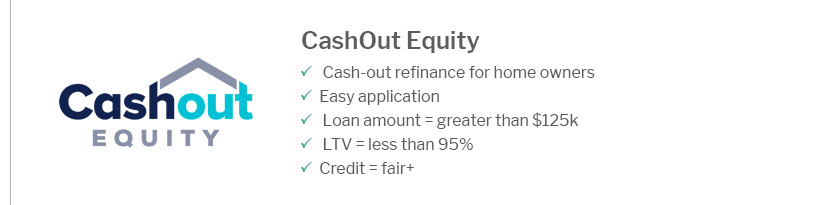

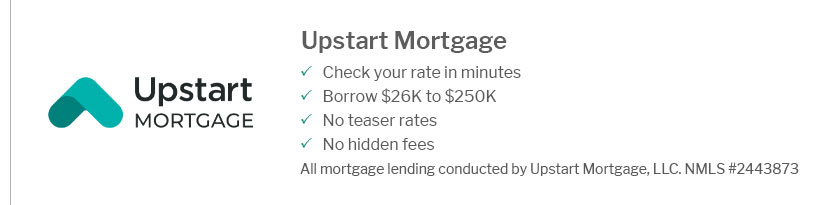

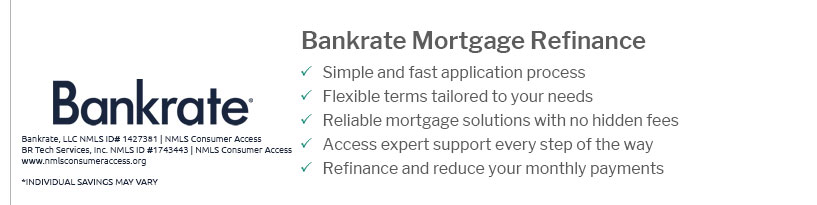

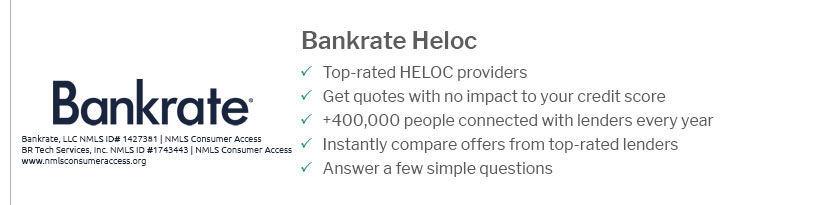

Online Mortgage LendersFor those seeking convenience, online lenders can be a great option. Consider these:

Factors to Consider When Choosing a LenderInterest RatesInterest rates can vary significantly between lenders. Always compare rates to ensure you're getting the best deal. Researching current jumbo mortgage rates colorado can also provide insights into broader market trends. Loan Terms and ConditionsEvaluate the loan terms, including repayment period and penalties. A longer-term might mean lower monthly payments but higher overall interest. Customer ServiceConsider lenders with excellent customer service, ensuring you have support throughout the loan process. This can be crucial for first-time homebuyers. Step-by-Step Process to Secure a Mortgage

Frequently Asked QuestionsWhat is the average interest rate for mortgages in Hawaii?The average interest rate for a 30-year fixed mortgage in Hawaii typically ranges from 2.5% to 3.5%, depending on the lender and market conditions. Can I get a mortgage pre-approval online?Yes, many lenders, including online platforms, offer mortgage pre-approval services through their websites, making it convenient to start your home buying journey. Are there specific loans for first-time homebuyers in Hawaii?Yes, there are specific programs for first-time homebuyers in Hawaii, such as FHA loans, which offer lower down payments and more lenient credit requirements. https://www.zillow.com/lender-directory/hi/

Looking for a lender? - Guaranteed Rate, Inc. - Element Mortgage HawaiiNMLS# 1850 - Ohana First MortgageGary L RosenbergNMLS# 337951 - Hawaii Mortgage Company, Inc. https://money.usnews.com/loans/mortgages/state/hawaii-mortgage-lenders

US News selects the Best Loan Companies by evaluating affordability, borrower eligibility criteria and customer service. https://www.reddit.com/r/Hawaii/comments/zv6cxy/mortgage_lenders/

Comments Section ; SillyCubensis - Shop around for rates, but in my experience Rocket is fastest and easiest. Maybe a bit higher rate, though. - 3

|

|---|